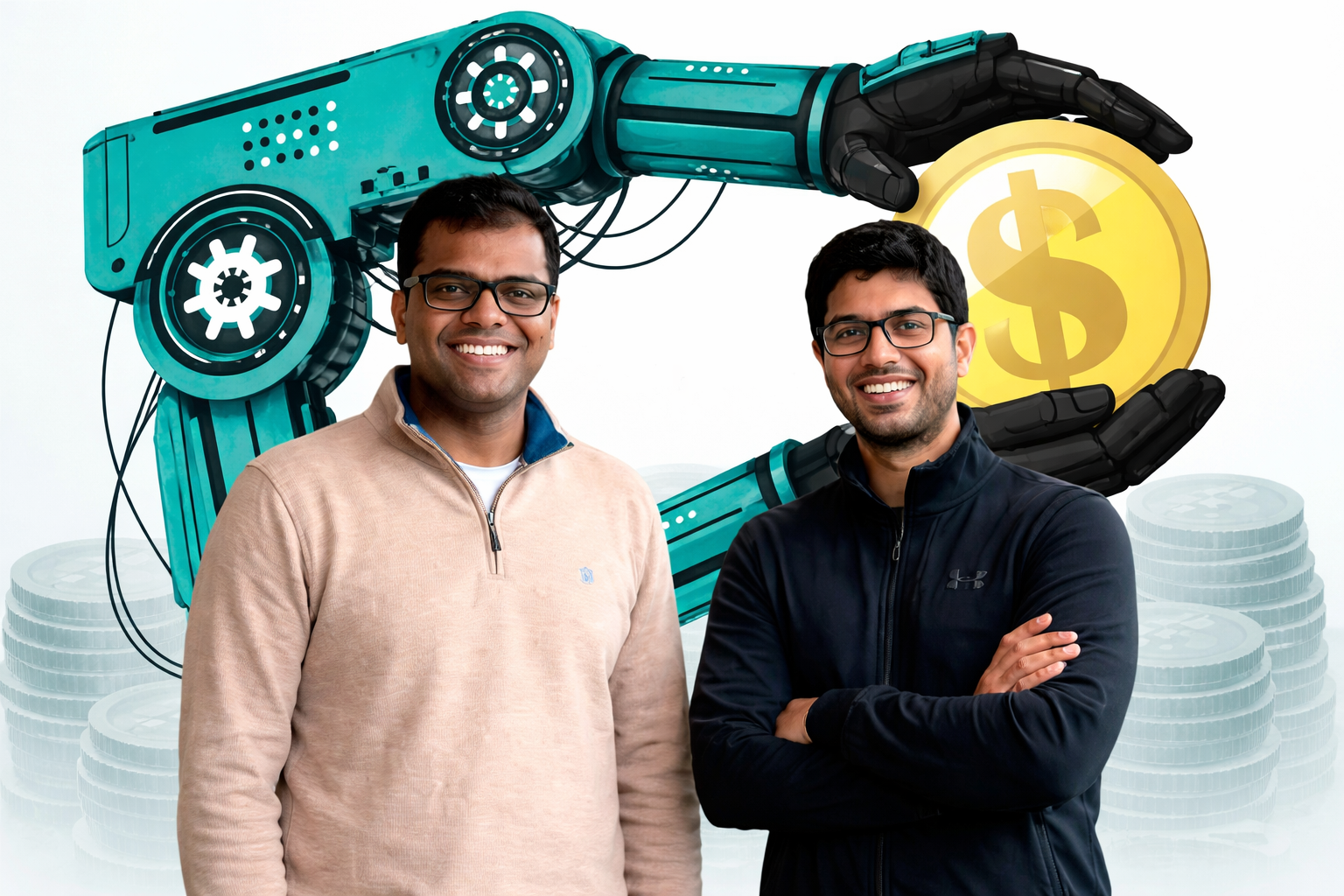

OpenCFO bags $2 mn funding led by Endiya Partners

OpenCFO, an AI-native financial operations platform, has raised $2 million in a funding round led by Endiya Partners, with participation from angel investors across the US and India. The fresh capital will be used to expand engineering teams, and hire senior talent with enterprise treasury deployment experience.

.png)

.png)

.webp)

.webp)

%20(1).webp)

%20(1).webp)

.webp)

.webp)

.webp)

.webp)

%20(1).webp)

.webp)